In many cases, GTM software underdelivers not because it lacks capability, but because teams commit to it before they are operationally ready to absorb it.

That observation has been coming up with increasing frequency in recent conversations with customer success leaders, RevOps teams, and GTM executives. Not as a complaint about specific vendors, and not as a rejection of platforms altogether, but as a quieter shift in when buying decisions are made.

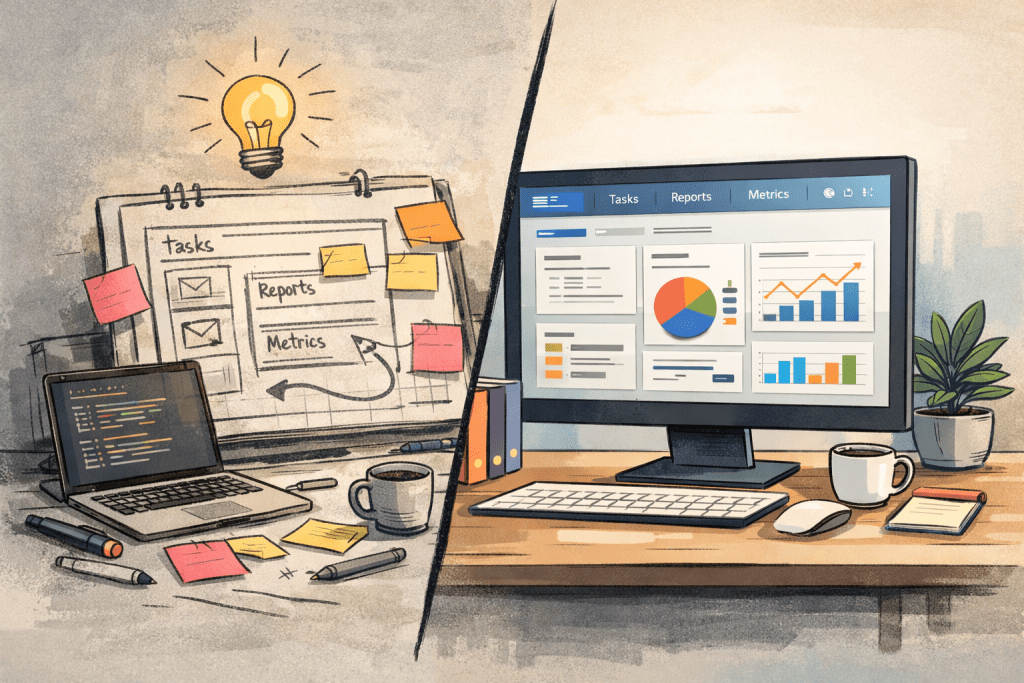

Instead of moving directly from problem recognition to platform purchase, some teams are inserting a new step in between: building lightweight, AI-assisted internal tools to pressure-test workflows before committing to a full solution.

What’s emerging looks less like “build versus buy” and more like “build to get ready.”

Let’s Discuss a Recent Example

This signal surfaced during a recent episode of the Prompted Podcast, where I sat down with customer success leader and advisor Mike Lemire to talk about AI, efficiency pressure, and how CS teams are rethinking platform decisions.

During that conversation, one story in particular stood out.

A CS team was actively evaluating Gainsight. The product was well understood. The value proposition resonated. The budget discussion was already underway. This was not a skeptical buyer looking for reasons to say no.

But the team paused.

Rather than signing a large, multi-year platform contract immediately, they asked a different question: What are the specific capabilities we’re excited about, and are we actually ready to use them well?

They listed the features that mattered most. Then, instead of purchasing the full platform, they ran a hackathon. Using AI-assisted tooling and low-code workflows, the CS team built a rough, internal version of those capabilities. It wasn’t elegant. It wasn’t scalable. And it wasn’t intended to be permanent.

As Lemire put it:

“Too often I see teams buy it before they’re actually ready for it, waste six months to a year of the SaaS cost while they’re getting ready for it, become frustrated with it, and dump it.”

The experiment wasn’t about avoiding Gainsight. It was about avoiding premature commitment.

Why this is happening now

Three forces appear to be converging to make this behavior more common.

First, AI has dramatically lowered the cost of experimentation.

What once required engineering cycles, budget approvals, and long lead times can now be assembled quickly with AI-assisted tools, internal builders, and short-term credits. Teams can prototype workflows, dashboards, and basic logic without making irreversible decisions.

Second, economic pressure has raised the bar for commitment.

Boards and CFOs are scrutinizing GTM spend more closely. Shelfware is harder to justify. Leaders are increasingly wary of buying platforms on vision alone and hoping adoption catches up later.

Third, organizational readiness has become more visible.

By attempting to build even a rough internal version of a workflow, teams quickly learn what data they have, what processes are unclear, and where ownership breaks down. That learning used to happen after purchase. Now it can happen before.

What this means for platforms like Gainsight

It would be easy to misread this pattern as a threat to established GTM or specifically CS platforms. In practice, it may signal the opposite.

In the example Lemire shared, the internal tool delayed a six-figure deal. But it also produced something more valuable: clarity.

“They’re going to be a better Gainsight customer eventually. They’re going to be a happier Gainsight customer. They’re going to drive more value out of it because they prepared themselves for that product and know with a higher degree of confidence that they’re ready for it.”

Rather than replacing the platform, the prototype acted as a forcing function. It clarified which metrics mattered, how workflows should operate, and where data needed to live. When the team eventually outgrows the internal solution, the transition to a full platform is likely to be faster and more intentional.

In that sense, this behavior doesn’t undermine the value of mature platforms. It reinforces the idea that their value compounds when customers arrive prepared.

It’s also important to note that this pattern isn’t unique to Gainsight. In practice, this same pause-and-prepare behavior could apply to any number of established customer success platforms teams regularly evaluate, including ChurnZero, Totango, Catalyst, Planhat, or similar solutions in the category. The specific vendor matters less than the underlying readiness decision GTM teams are now making.

What’s getting harder, and what’s getting easier

This shift subtly changes the buying environment.

What’s getting harder:

- Closing large platform deals early, before workflows are defined

- Selling primarily on future-state vision without near-term proof

- Justifying long contracts when teams are still sorting out fundamentals

What’s getting easier:

- Pressure-testing assumptions before committing budget

- Identifying readiness gaps early

- Entering platform purchases with conviction instead of hope

The decision isn’t “do we need this platform?” but “are we ready to use it well right now?”

The Analyst perspective

One of the more interesting aspects of this pattern is that it reframes AI’s role in GTM buying.

AI is not only automating tasks or augmenting decision-making. In these cases, it’s acting as a delay mechanism. It gives teams permission to slow down, learn, and mature before locking in major commitments.

That delay may feel uncomfortable for vendors in the short term. But it may also produce customers who adopt faster, churn less, and extract more value over time.

The bigger shift is not about whether teams build or buy. It’s about how much confidence they require before they buy.

A question for GTM leaders

Are you finding yourself building lightweight tools or AI-driven stopgaps to test workflows before committing to a full platform?

If so, is that changing when you buy, not just what you buy?

We are increasingly seeing this behavior surface quietly across GTM teams. It may not replace platform buying. But it may be reshaping the path teams take to get there.

If you are seeing or experiencing any of this in your own GTM buying decisions, we would love to talk with you. We are actively looking to understand different perspectives and, where appropriate, share those stories with the broader 3Sixty Insights audience.